Life doesn’t always go as smoothly as we’d like, and there are times when your finances can get a little out of hand. We understand there are many reasons why you might not have the perfect credit score, so at Look After My Mortgage, we look at your own merits. This includes making sure any potential impacts from Covid-19 are also considered. We’re here to help you realise your dreams, so if there’s a way to make it happen, we’ll find it.

Look After My Mortgage can consider clients with blips on their credit rating, such as:

CCJ’s (county court judgements), defaults, mortgage arrears, credit card, mail order communication and utilities issues, unsecured and secured arrears.

Look After My Mortgage, we offer mortgage products to suit borrowers with a wide variety of credit histories and can cascade borrowers through our tiers depending on any credit blips they may have.

We welcome first time buyers, re mortgages, movers and buy to lets.

We love to talk a case through, why not talk to a friendly advisor today.

Your home may be repossessed if you do not keep up repayments on your mortgage.

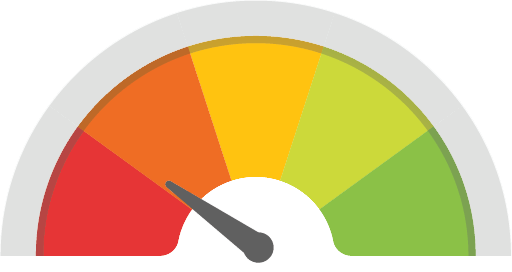

Low Credit Score?

Getting a mortgage with a low credit score can be challenging, but it’s not impossible. In the UK, most mortgage lenders use credit scoring as a standard part of their mortgage application process to assess a borrower’s creditworthiness. Credit scoring helps lenders evaluate the risk associated with lending money to a particular applicant. Therefore, it’s quite rare to find mortgage lenders in the UK that do not perform any form of credit check or credit scoring.

However, there are some niche or specialist lenders that we work with that will be more lenient when it comes to credit scoring and may consider other factors alongside your credit history when making lending decisions. These lenders typically cater to individuals with unique financial situations, such as those with adverse credit histories or low credit score.

Getting a mortgage with a CCJ (County Court Judgment)

A CCJ (County Court Judgment) can have significant implications for individuals seeking a mortgage. When a person is issued a CCJ, it means they have failed to repay a debt and a court has ruled in favor of the creditor, ordering them to pay the owed amount. This legal judgment can negatively impact a person’s credit score, making it more challenging to secure a mortgage. Lenders typically view CCJs as a sign of financial instability and increased risk, which may result in higher interest rates or even outright rejection of mortgage applications.

Our mortgage experts have access to lenders that will accept CCJ (County Court Judgment).

We will need to see a copy of your credit file using the further down this page.

Getting a mortgage with a default.

Obtaining a mortgage with a history of default can be challenging, but it’s not impossible. Lenders typically view borrowers with defaults as higher risk, which means they may require a larger down payment, charge higher interest rates, or have stricter eligibility criteria. However, individuals looking to secure a mortgage with a default can take several steps to improve their chances. First, it’s essential to address the default and bring the account current if possible. Demonstrating responsible financial behavior afterward, such as consistently making payments on time and rebuilding credit, is crucial. Additionally, seeking the assistance of a mortgage expert who specializes in working with borrowers with credit challenges can be beneficial, as they can help identify lenders willing to consider your application. While the process may be more complex and require patience, with dedication and a commitment to responsible financial management, it is possible to eventually secure a mortgage even with a history of default.

Speak to our adverse specialist today.

Reviews

FAQs

How do a check my credit file?

Checking your credit history and credit scores can help you better understand your current credit position.

You should check your credit reports every now and again, so you can help you be more aware of what lenders may see. Checking your credit reports can also help you detect any inaccurate or incomplete information.

There are various platforms and Look After My Mortgage have partnered up with Check My File plus use think link to view your credit report: We suggest using this link only as it has been approved so we know it is not a fraudulent link.

What are the benefits of a first-time home buyer mortgage in Lincoln?

The benefits of a first-time home buyer mortgage in Lincoln include lower down payment requirements, more favourable interest rates, and reduced closing costs.

How do I compare first-time home buyer mortgage rates in Lincoln?

How do I compare first-time home buyer mortgage rates in Lincoln? A: You can compare first-time home buyer mortgage rates in Lincoln by using an online mortgage comparison tool or working with a local mortgage broker. Be sure to compare rates and terms from multiple lenders to find the best deal for your needs.